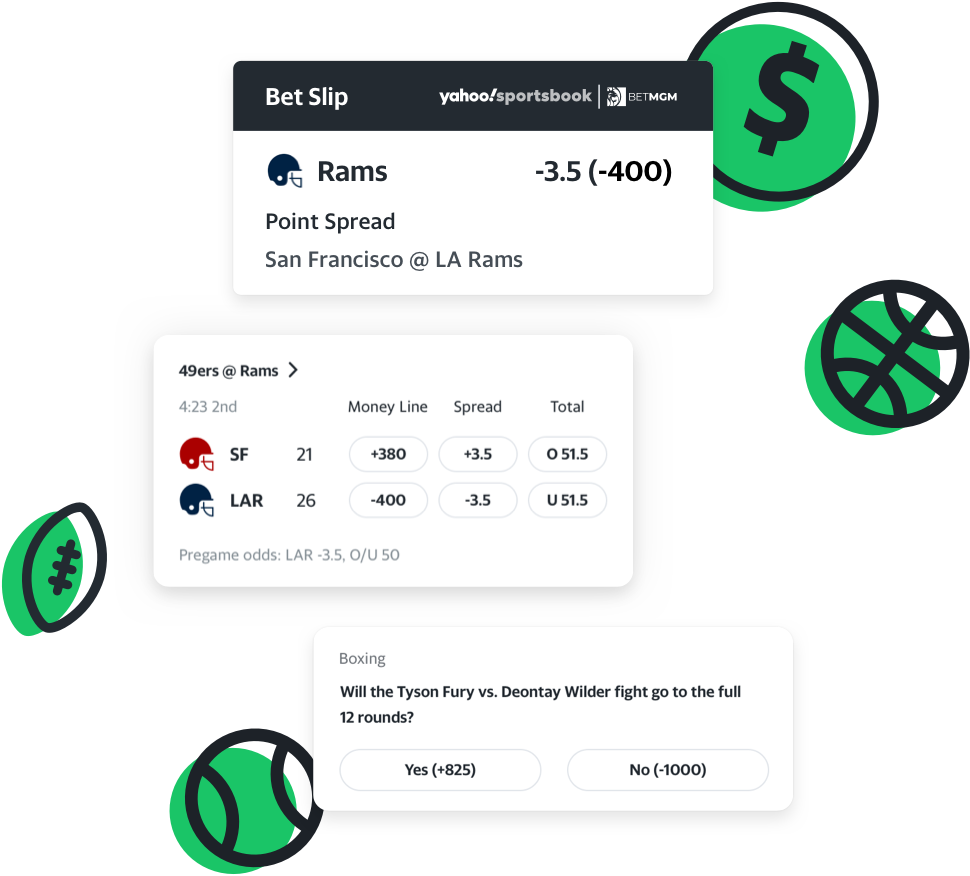

The point spread allows you to place wagers on a game using predicted scores. This is most popular in NFL games. However, it is also used in many other sports. The point spread shows the expected difference in the final scores of the teams. As a result, the point spread can be both positive and negative. For example, a 3-point spread indicates that the favorite team is expected not to win by less three points and the underdog by more three points.

Sportsbooks offer a guarantee for a point spread wager

A point spread can be described as a type of wager where the sportsbooks calculate the ultimate margin of victory for two teams and allow bettors the opportunity to place a wager based on that estimate. It is common for a favorite team to win by more than the spread while an underdog will win less. The best thing about betting on the point spread? There is very little risk of losing.

However, the lines of a betting site can affect the outcome. It is quite common for the betting line in favor of a book to move in the book's favor. This can lead to the book losing money. In these cases, bookmakers will move the point spread to try to lure bettors to the side with less-wager money.

These algorithms are used to predict future events

Predictive algorithms make use of machine learning and deep learning to predict outcomes. Deep learning deals with unstructured information, such as audio, video and social media posts. Machine learning is for structured data. Predictive algorithms can classify massive amounts of data using a decision tree approach.

Predictive algorithms are used by sportsbooks to create odds for in-game betting. These algorithms can instantly predict a specific percentage of possible outcomes. While point spreads are calculated by betting books, they can't always be 100% accurate. The goal is for a point spread to be as close to the correct value as possible to minimize risk and manage risk.

They are very well-liked in the NFL

The NFL's point spreads are very popular because they allow for more fair betting. Point spreads are a way for sportsbooks to make money by making money on both sides. This makes it easier to select which team you want to bet. It is important to be aware both of the current team form as well as current points spreads. You should research the team before you place your bets.

You can bet on the point spread and the money line of a game. Pay attention to the fact that the moneyline value may not reflect the actual game outcome. Because point spreads may not always be indicative of the final score, this is important to remember. You should also be aware of the possibility that a team losing could win by covering a point spread. For example, if you bet on the Kansas Sooners, you should be aware that the spread will not be accurate.

You can use them for many other sports.

A wide variety of sports use point spreads. They are generally read the same way, but differ in how they are scored. For example, football games are scored by goals while basketball games use points. A professional bettors will be able advise you on the best way for you to interpret a point spread.

While most people bet on football and basketball games, point spreads are also used in a number of other sports. A team may be favored as low as 1.5 goals in ice hockey.

FAQ

Why is personal finance important?

For anyone to be successful in life, financial management is essential. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

So why do we put off saving money? Is there anything better to spend our energy and time on?

Yes and no. Yes, most people feel guilty saving money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. Negative thoughts will keep you from having positive thoughts.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. You don't know how to properly manage your finances.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting means putting aside a portion every month for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. When you run out of money, reduce your spending.

But how much do you consider too much? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. You should not spend more than $2,000 a month if you have $20,000 in annual income. For $50,000 you can spend no more than $5,000 each month.

Paying off your debts quickly is the key. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. You can still expect interest to accrue if your money is saved.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. You'd have more than $57,000 instead of $40,000

This is why it is so important to understand how to properly manage your finances. Otherwise, you might wind up with far more money than you planned.

How do wealthy people earn passive income through investing?

There are two main ways to make money online. Another way is to make great products (or service) that people love. This is called "earning” money.

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is to create apps. You decide to give away the apps instead of making them available to users. Because you don't rely on paying customers, this is a great business model. Instead, you rely upon advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how internet entrepreneurs who are successful today make their money. Instead of making money, they are focused on providing value to others.

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires effort and hard work.

Active income is when you create value for someone else. Earn money by providing a service or product to someone. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because you can focus on other important things while still earning money. However, most people don't like working for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

It is possible to burn out if your passive income efforts are too intense. So it's best to start now. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are 3 types of passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What is the best passive income source?

There are many options for making money online. But most of them require more time and effort than you might have. How do you make extra cash easy?

The solution is to find what you enjoy, blogging, writing or selling. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is affiliate marketing. There are lots of resources that will help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

As another source of passive income, you might also consider starting your own blog. It's important to choose a topic you are passionate about. After you've created your website, you can start offering ebooks and courses to make money.

There are many ways to make money online, but the best ones are usually the simplest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

Once you have created your website, share it on social media such as Facebook and Twitter. This is content marketing. It's an excellent way to bring traffic back to your website.

How to create a passive income stream

To generate consistent earnings from one source, you have to understand why people buy what they buy.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

The next step is to learn how to convert leads in to sales. The final step is to master customer service in order to keep happy clients.

Although you might not know it, every product and service has a customer. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire it takes a lot. To become a billionaire, it takes more effort. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

And then you have to become a millionaire. Finally, you can become a multi-billionaire. You can also become a billionaire.

How does one become a billionaire, you ask? You must first be a millionaire. All you have do is earn money to get there.

You must first get started before you can make money. Let's take a look at how we can get started.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money online

How to make money online today differs greatly from how people made money 10 years ago. It is changing how you invest your money. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are easier than other. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out who you are as an investor. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. Do your research before you sign up for any program. You should read reviews, testimonials, as well as past performance records. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not just jump in to one huge project. Instead, begin by building something basic first. This will allow you to learn the ropes and help you decide if this business is for you. After you feel confident enough, you can start working on larger projects.

-

Get started now! It's never too soon to start making online money. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All you need is a good idea and some dedication. Now is the time to get started!